Renters Insurance in and around Chicago

Renters of Chicago, State Farm can cover you

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

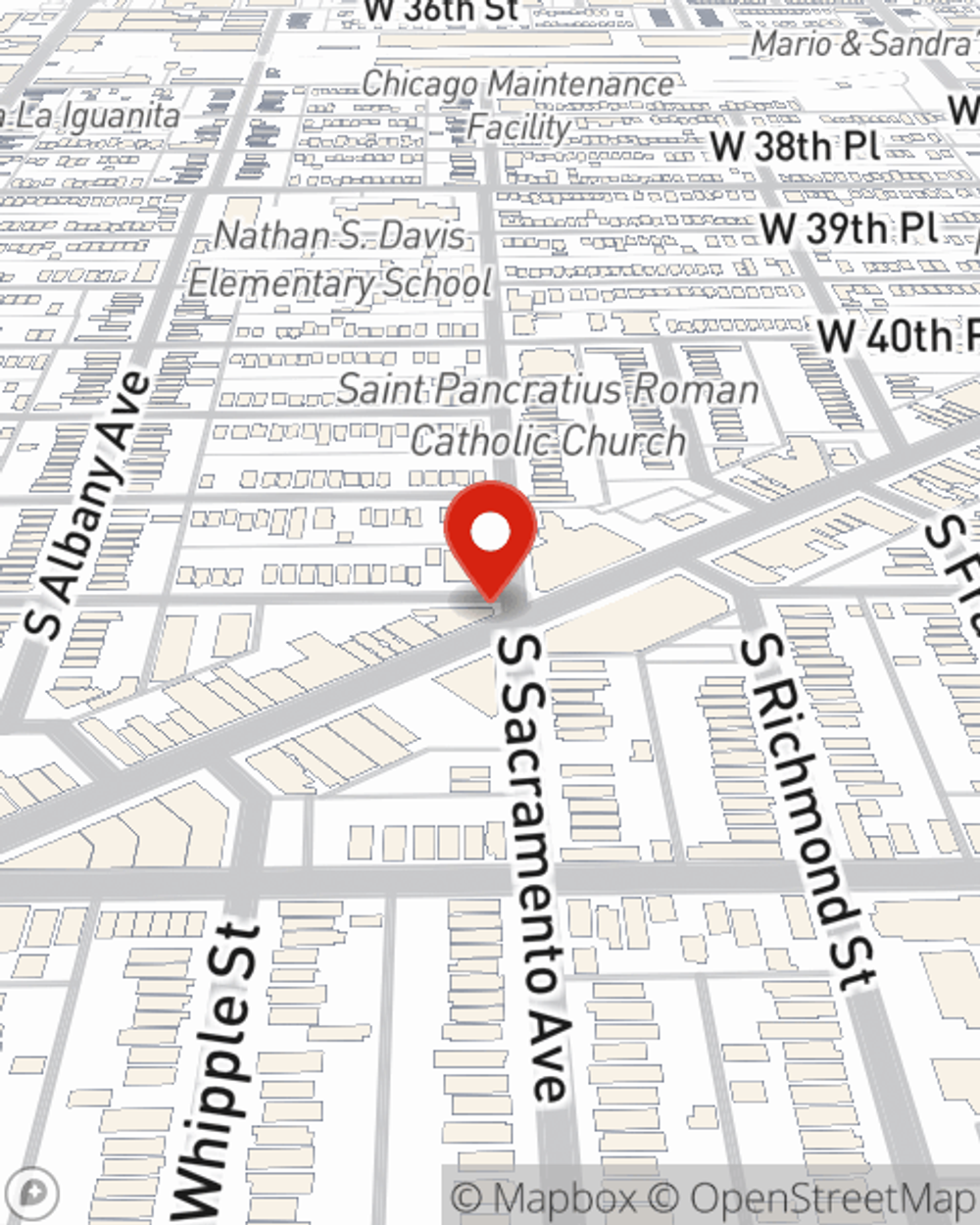

- Chicago

- Brighton park

- little village

- back of the yards

- gage park

- Pilsen

Calling All Chicago Renters!

Your rented house is home. Since that is where you rest and spend time with your loved ones, it can be beneficial to make sure you have renters insurance, even if your landlord doesn’t require it. Even for stuff like your fishing rods, books, hiking shoes, etc., choosing the right coverage can insure your precious valuables.

Renters of Chicago, State Farm can cover you

Your belongings say p-lease and thank you to renters insurance

Protect Your Home Sweet Rental Home

Renters rarely realize how much money they have tied up in their possessions. Just because you are renting a townhome or apartment, you still own plenty of property and personal items—such as a coffee maker, set of favorite books, set of golf clubs, and more. All of these have value, which would be a real loss if damaged or destroyed. That's why you need renters insurance from State Farm. Why get renters insurance from Bill Klinowski? You need an agent with a true desire to help you choose the right policy and evaluate your risks. With competence and dedication, Bill Klinowski is waiting to help you discover the State Farm advantage.

Contact Bill Klinowski's office to see how you can save with State Farm's renters insurance to help keep your valuables protected.

Have More Questions About Renters Insurance?

Call Bill at (773) 376-2348 or visit our FAQ page.

Simple Insights®

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.

Bill Klinowski

State Farm® Insurance AgentSimple Insights®

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.